Last Updated on: 27th January 2025, 09:39 am

If you’ve found yourself gearing up to submit your annual income tax return and suddenly realize that you’ve forgotten your FBR IRIS password, don’t worry. You can easily retrieve it using the “Forgot Password” option on the FBR IRIS portal.

How Can I Recover My FBR IRIS Password?

It’s important to note that password recovery can no longer be done solely through the FBR Maloomat TaxRay Portal using your cell number. You now need to utilize your cell number and email ID through the FBR IRIS portal.

If you no longer have access to either your registered cell number or email, you’ll need to visit your respective Regional Tax Office (RTO) with your original CNIC ID Card. There, you can fill out a form and submit it to the FBR office to update your information with a new cell number and email address.

Here are the New Salary Tax Slabs 2025-26 Pakistan

Once your details are updated at the FBR RTO office, you can easily forget your password and recover it by following these steps:

Step-by-Step Guide to Reset Your FBR IRIS Password

Here is a step-by-step guide on how to recover your password for filing your tax return:

1. Visit the FBR Iris Login Page:

Go to the FBR IRIS web portal here and click on the “Forgot Password” option.

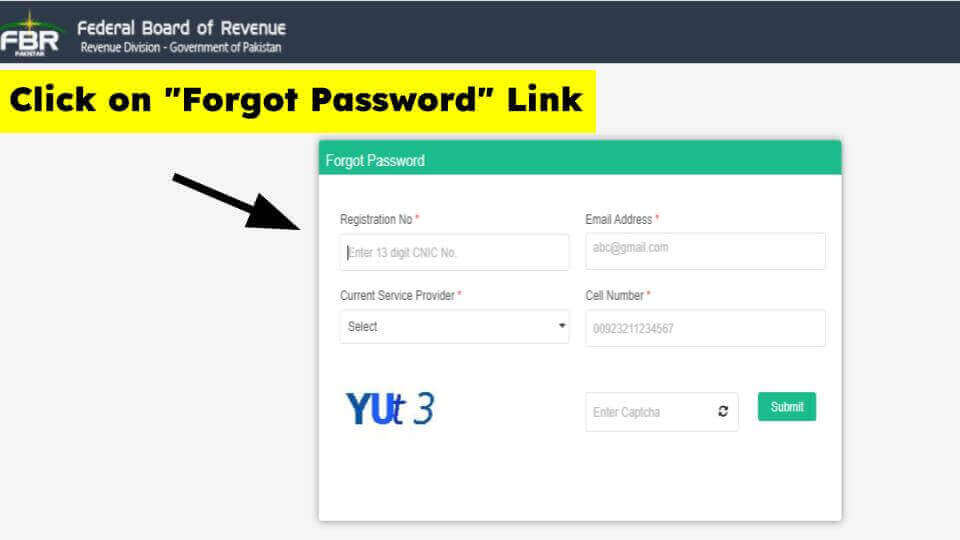

2. Click on the “Forgot Password” Link:

Find and click on the “Forgot Password” tab, located in the middle of the page, next to the “Sign In” option on the right side.

3. Enter Your Required Information on the “Forgot Password” Form:

After clicking on “Forgot Password,” a form will appear. Fill in all the required information, such as your registered cell number, email ID, and Registration No (which may be your CNIC No or NTN No in the case of a partnership business or a private limited company).

4. Submit the Form:

Once you’ve provided all the necessary information, submit the “Forgot Password” form.

5. Check Your Email and Cell for a Recovery Code:

After submitting the form, FBR will send verification codes to your registered email and cell number. Request the taxpayer to provide you with both verification codes and then enter them in the required fields on the form. After filling out the form with both verification codes, submit it.

Here’s How To File Income Tax Return in Pakistan

6. If You Don’t Receive Verification Codes:

In case you don’t receive the verification codes on your cell number, send a message from your registered mobile by texting “msg” to “9966.” You will receive the cell verification code soon after sending this message. If the verification code does not appear in your email inbox, be sure to check your “Junk” email folder.

7. Set a New Password for the FBR IRIS Portal:

Once the verification codes have been entered and verified by FBR, you can set a new password for the FBR IRIS Portal. Ensure that your new password includes a combination of alphanumeric characters, both lowercase and uppercase letters, and special characters (e.g., #@$).

8. Confirm the New Password:

After setting a new password, verify that it works by signing in to the FBR IRIS portal using the new password. You can then use it to submit your tax return on time.

This updated version provides a clear and concise step-by-step guide to recovering your FBR IRIS password.

Researcher, Blogger, Content Writer, Online Marketing Expert, Aptitude Test & Admissions Expert, Career Counselor.

PEC REGISTERED. ENGINEER. (NED University of Engineering & Technology)

CEO / Founder (The Educationist Hub)