Last Updated on: 14th July 2023, 07:46 am

Govt Announced Tax Deductions For The Freelancers, IT Sector, And Bank Loans

The federal government has decided to lower the tax rates for investments in the IT sector, offer tax breaks for the self-employed, and standardize tax-free devices in order to encourage investments in this sector.

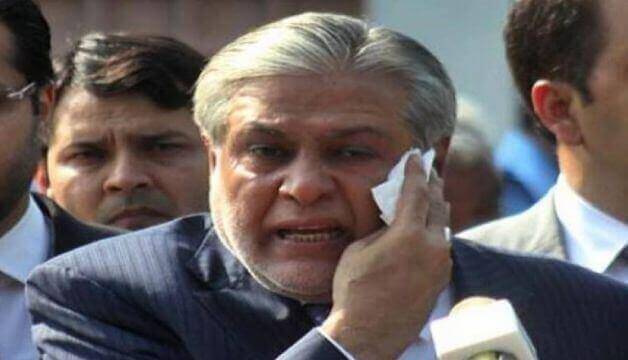

In today’s 2023-24 budget presentation, Finance Minister Ishaq Dar Friday also proposed maintaining the reduced personal income tax rate of 0.25% for the next three years to encourage computer exports to the country.

Recognizing the country’s tremendous talent in information technology, Dar demanded that banks should benefit from a lower 20% tax rate to facilitate lending for investments in the IT sector, recalling that the tax rate for banks is currently the standard for investments corresponds to 39%.

The finance minister further reported that the government had recommended offering duty-free equipment locally to encourage investment in the IT sector. It was recommended that the industry be given SME status so that individuals can benefit from reduced, special, and exclusive income tax rates on this item.

For exporters of IT/IT-related services, Dar offered to issue automatic exemption certificates for non-residents within 30 days and a GST reduction from 15% to 5% for IT and ITeS services in Islamabad (TIC).

The minister recommended removing the obligation to file personal VAT returns in order to benefit from the preferential rate of 0.25%. “Pakistani youth are working from home as freelancers, bringing vital money to the country,” the minister added.

Dar proposed exempting these individuals from sales tax registration and filing a simplified one-page tax return if their computer and computer services exports were less than $24,000 in the previous tax year.

Also Read: Federal Govt Announces Increases in Salaries And Pensions By Up To 35%